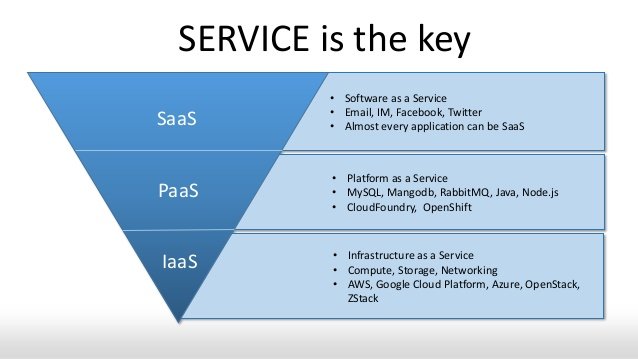

The Security Layer Every Trading SaaS Must Have

Trading platforms face growing security threats every day. In fact, cyberattacks on SaaS systems have risen by over 50% in recent years. This guide explains the essential layers required to keep your trading platform protected from these risks.

Stay with us to learn how to secure your system effectively.

Identity and Access Management (IAM)

Protecting user accounts is like locking the doors to your house. Strong identity measures stop unwanted guests from sneaking in.

Multi-Factor Authentication (MFA)

Cybersecurity experts consider MFA essential for trading platforms. It enhances security by requiring multiple steps to access accounts. Users must provide two or more credentials, like a password and a one-time code sent to their phone.

This makes it more difficult for hackers even if they crack the first code.

Traders gain from this because it safeguards sensitive data from breaches. For example, using biometric scans like fingerprints further prevents unauthorized logins. As cyber threats grow more complex, relying on just passwords is extremely risky.

Adding MFA ensures that bad actors encounter obstacles at every turn.

Passwords are weak links; MFA builds strong defenses.

Granular permission settings

Limit access to sensitive data through clearly defined permission controls. Assign specific roles to users based on their job responsibilities. For instance, a junior trader should not see administrative settings or critical backend systems.

Restrict unnecessary permissions to reduce potential risks and human errors.

Add additional measures by splitting access into smaller tasks within the same role. A customer service agent might view account details but not process withdrawals. This separation safeguards sensitive actions from misuse or accidental changes, promoting stronger protection.

Regular access reviews

Regular access reviews play a critical role in securing your trading SaaS. This process helps protect data and ensures the right people have access.

- Review user permissions frequently to address outdated or excessive rights. Traders switching roles or leaving systems can leave behind vulnerabilities.

- Reduce risks by removing unnecessary access quickly. Stale accounts are cybercriminals’ favorite backdoors.

- Compare every user’s level of permission against their job function. Over-privileged accounts increase exposure.

- Audit third-party integrations with equal focus. Vendors with weak security can create gaps within your infrastructure.

- Use automated tools to conduct audits efficiently. Manual checks are prone to human error, especially in larger systems.

- Maintain detailed logs for tracking changes in permissions over time. These records support compliance efforts during regulatory inspections.

- Consult senior security experts to evaluate review processes for possible blind spots in oversight routines.

Properly structured reviews strengthen cybersecurity and address threats like unauthorized access or insider attacks without relying on reactive measures alone.Platforms often extend these principles to trading behavior as well. Systems enforce checks like the Robinhood daily trade limit to control activity frequency and reduce exposure to financial or compliance risks.

Data Security and Encryption

Hackers are like pickpockets, always looking for a way in. Encrypting data keeps your sensitive information locked up tight.

Data encryption at rest and in transit

Encryption safeguards sensitive trading data from unauthorized access. When stored, it protects information like user credentials or transaction records. For example, databases can apply AES-256 encryption to encode data into unreadable formats.

This ensures that even if attackers access the storage system, they encounter meaningless information.

During transmission, encryption protects data traveling between systems or across networks. TLS (Transport Layer Security) secures APIs and customer interactions by encoding communication streams.

A straightforward example is your browser connecting securely to a trading app through “https.” As traders depend on real-time decisions, encrypted transfers ensure cybercriminals cannot intercept critical insights during transmission.

Trading platforms without encryption are as vulnerable as open safes in a crowded room.

Compliance with regulations like GDPR

Governments created laws like GDPR to protect personal information. Companies that fail to follow these rules can face steep fines, with penalties reaching up to €20 million or 4% of global revenue.

Trading SaaS platforms must enforce strict data protection measures to avoid violations. They need clear policies on how they collect, store, and process user data.

Encryption methods should meet GDPR standards for securing sensitive details during transit and storage. User consent is not just polite; it’s legally required before collecting any personal information.

Detailed records of compliance efforts help demonstrate readiness if audits occur. Building a secure infrastructure ensures adherence to legal frameworks while lowering risks tied to cyberattacks or human errors.

Data loss prevention strengthens resilience in trading systems against potential leaks or breaches.

Data loss prevention mechanisms

Protect sensitive trading data by establishing regulations that oversee and manage its movement. Prevent unauthorized file transfers or downloads to mitigate risks. For instance, limit access to cloud storage for specific users or geographical areas.

Install tools that identify suspicious actions, such as large-scale data exports. These notifications can stop breaches before they worsen. Regularly encrypt backups to secure information, even in cases of hardware malfunctions.

Infrastructure and Application Security

Strong defenses prevent threats from reaching critical systems—discover ways to safeguard them more effectively.

Network and application firewalls

Firewalls act like security guards for your trading SaaS. Network firewalls monitor incoming and outgoing traffic, blocking suspicious data packets before they reach critical systems.

Application firewalls provide additional protection by inspecting specific app-level requests to prevent threats like SQL injections or cross-site scripting.

Hackers often target weak spots in software or networks. A strong firewall setup reduces that risk significantly by acting as a barrier between internal systems and external attacks.

Both types of firewalls work together to provide layered protection, ensuring uninterrupted operations for traders while protecting sensitive financial data.

Secure Software Development Life Cycle (SDLC)

Firewalls help block unwanted traffic, but software itself must be built with safety in mind. A Secure Software Development Life Cycle (SDLC) incorporates security checks at every step of coding.

Developers test for vulnerabilities while writing code instead of waiting until the end. This prevents potential threats early.

Traders rely on stable and protected platforms. Regular code reviews identify errors that could expose data to hackers or disrupt key functions. Automated tools analyze for known risks like weak passwords, unencrypted data paths, or suspicious access points during development stages.

Frequent updates address flaws before attackers exploit them, keeping your trading secure.

API security measures

Securing APIs is critical for preventing unauthorized access and data breaches. Use authentication methods like OAuth 2.0 to verify user identities before granting access. API keys should be unique per user and rotated regularly to limit exposure.

Limit API access with rate limiting, so bad actors cannot overload the system with requests. Monitor all API activity in real time to detect suspicious behavior early. Encrypt sensitive data transmitted via APIs using protocols like HTTPS for an additional layer of protection.

Human Security Layer

Cybercriminals often exploit human errors more than technical flaws. Training your team is as crucial as locking your doors at night.

Employee training programs

Employees play a huge role in maintaining the security of your trading SaaS platform. Proper training helps them recognize threats and respond swiftly.

- Inform employees about phishing attacks and social engineering tactics. Share real-life examples to reinforce the lessons.

- Teach staff to identify suspicious emails, links, and attachments. Emphasize the importance of avoiding clicking on anything questionable.

- Conduct regular workshops on data protection practices, such as password management and device security.

- Clearly explain access control policies. Ensure team members understand why limited access is essential.

- Organize mock security drills to simulate attacks like ransomware or phishing scams.

- Provide straightforward guides for reporting potential cybersecurity incidents without delay.

- Foster accountability by sharing success stories of employees who have helped mitigate threats.

- Track participation rates, and motivate teams to stay informed about emerging risks in cybersecurity.

- Incorporate engaging tools like videos or interactive scenarios to make learning effective for all skill levels.

- Schedule sessions periodically to ensure knowledge remains fresh across your workforce!

Incident response procedures

An effective incident response procedure can save Trading SaaS platforms from chaos. It minimizes damage, protects data, and keeps systems running.

- Define clear roles for the response team. Assign specific tasks to each team member to avoid confusion during emergencies.

- Create a step-by-step incident response plan. Outline what actions to take after detecting a breach or threat.

- Conduct regular drills and simulations. Test the plan against real-world scenarios to find gaps in your strategy.

- Document every detail of the incident process. Log findings, actions taken, and timelines for future audits or reviews.

- Communicate transparently with stakeholders during incidents. Inform traders about system updates without causing panic or uncertainty.

Understanding human security layers is essential after planning these procedures!

Continuous monitoring and threat detection

Monitoring trading SaaS platforms consistently ensures safety. Detecting threats early prevents damage and ensures smoother operations.

- Use automated tools to scan for unusual activity 24/7. They identify suspicious login attempts or unauthorized data access.

- Implement threat intelligence systems that analyze patterns immediately. These tools help you respond faster to new risks.

- Install alerts that notify teams of breaches right away. Fast responses reduce the effect on users and data security.

- Conduct routine vulnerability assessments across networks and applications. Regular checks help identify weak points attackers may target.

- Monitor API traffic since APIs often expose sensitive endpoints in trading SaaS platforms. Controlling API interactions reduces risks.

- Log all user actions, including setup changes or transaction history access, to detect insider threats before harm is done.

- Publish reports on security findings for transparency with users and stakeholders, increasing confidence in the SaaS system’s defenses.

- Test disaster recovery plans often by simulating cyberattacks like phishing or ransomware incidents using red team drills.

Conclusion

Protecting a trading SaaS is like securing a vault. Without the proper security layers, the risks are too significant to overlook. Robust IAM, encryption, and training create a strong defense against threats.

Traders deserve confidence when using your platform. Prioritize these measures to protect trust and data equally.