Thomas Laffont: The Visionary Mind Behind a Global Investment Powerhouse

Introduction

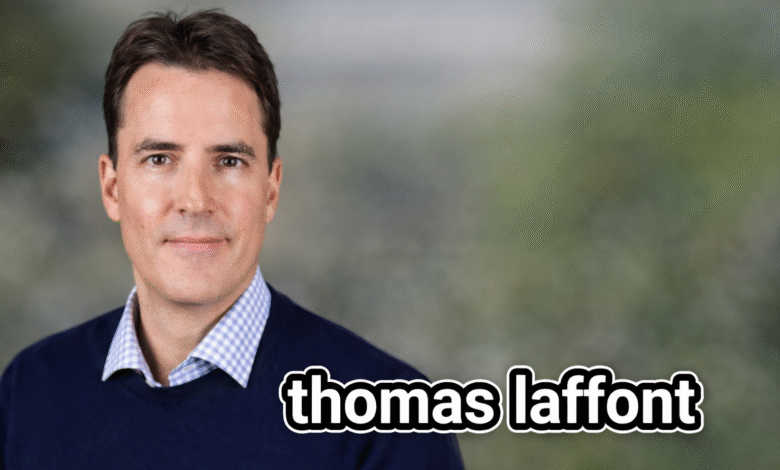

Thomas Laffont is widely recognized as a key figure in modern technology investing. As a co-founder of a major global investment firm, his influence extends across public and private markets, shaping how capital flows into innovation. He is often described as strategic, analytical, and forward-looking, yet his low public profile has also led to curiosity, assumptions, and occasional misconceptions.

This article offers a complete, verified, and carefully structured biography of Thomas Laffont. It focuses only on confirmed information, avoids speculation, and presents both positive and critical perspectives in a balanced tone. The goal is to provide content that is useful for readers, clear for search engines, and trustworthy for long-term reference.

Quick Bio

| Field | Information |

|---|---|

| Full Name | Thomas Laffont |

| Nationality | American |

| Profession | Investor, Business Executive |

| Known For | Co-founder of Coatue Management |

| Education | Yale University (Bachelor’s degree) |

| Career Start | Late 1990s |

| Current Role | Senior leadership in global investing |

| Public Profile | Low-key, private |

Who Is Thomas Laffont?

A Private Figure in a Public Industry

Thomas Laffont is an American investor best known for co-founding Coatue Management, a technology-focused investment firm with a global reach. Unlike many high-profile investors, he maintains a reserved public presence, allowing his work and results to speak louder than personal branding.

This privacy has helped him avoid unnecessary controversy, but it has also limited public understanding of his personal journey. What remains clear is his long-term commitment to disciplined investing and institutional growth rather than short-term attention.

Education and Intellectual Foundation

Academic Roots That Shaped Strategy

Thomas Laffont earned his undergraduate education from Yale University, one of the world’s most respected academic institutions. His studies provided a strong analytical foundation, critical thinking skills, and exposure to complex systems.

While his exact field of study is not publicly detailed in reliable sources, his later career reflects deep comfort with data, technology, and economic trends. This academic grounding played a significant role in shaping his structured and research-driven investment philosophy.

Early Career and Professional Direction

From Talent Representation to Finance

Before fully entering the investment world, Thomas Laffont began his professional career at Creative Artists Agency (CAA). This early experience outside traditional finance exposed him to talent management, negotiation, and relationship-building.

Although this path was unconventional for a future investor, it proved valuable. The entertainment industry sharpened his understanding of human capital, long-term value creation, and strategic partnerships. However, transitioning industries also carried risk, requiring adaptability and patience during the early stages of his career.

The Founding of Coatue Management

Building a Long-Term Investment Platform

Thomas Laffont co-founded Coatue Management in 1999, helping establish a firm that would later become a major force in technology investing. From the beginning, the firm focused on combining deep research with global market awareness.

One positive aspect of this approach was its ability to adapt across market cycles. On the negative side, heavy exposure to technology sectors can increase sensitivity to volatility. Despite this, the firm’s long-term orientation has allowed it to navigate changing economic conditions with resilience.

Investment Philosophy and Business Strategy

Data, Discipline, and Conviction

Thomas Laffont is known for supporting an investment style grounded in research, long-term conviction, and sector expertise. The firm’s strategy integrates public equities with private investments, creating continuity across growth stages.

This model offers flexibility and insight but also demands rigorous risk management. While it has delivered strong influence and scale, it requires constant evaluation to avoid over-concentration. His leadership reflects an understanding that even strong strategies must evolve.

Companies and Business Ventures

A Platform Rather Than a Portfolio

Rather than building a personal brand around individual companies, Thomas Laffont operates through an institutional platform. His primary business venture remains Coatue Management, which invests across technology-driven industries.

This structure allows diversification and scale, though it limits public visibility into personal decision-making. The trade-off favors stability and governance over individual recognition, aligning with his professional style.

Income, Wealth, and Financial Standing

What Is Known and What Is Not

Thomas Laffont’s income is derived from his executive and ownership role within an investment firm. It includes management responsibilities and long-term investment performance.

However, exact net worth figures, salary details, and personal financial disclosures are not publicly confirmed. Any specific numbers often cited online are estimates and should be treated cautiously. Transparency in this area remains limited by design.

Public Presence and Media Coverage

Influence Without Noise

Unlike many industry leaders, Thomas Laffont rarely appears in mainstream media or public commentary. Most coverage centers on institutional activity rather than personal narratives.

This low visibility is a strength for long-term focus but can be perceived as a lack of transparency. In reality, it reflects a deliberate choice to prioritize execution over exposure.

Legacy and Industry Impact

Shaping Modern Technology Investing

Thomas Laffont’s legacy is closely tied to institutional innovation in investment management. He has contributed to a model that integrates data, global insight, and long-term thinking.

Positively, this approach has influenced how capital supports innovation at scale. Critically, it also reinforces the concentration of financial power within large institutions. Both perspectives are essential to understanding his role in the broader financial ecosystem.

Conclusion

Thomas Laffont represents a disciplined, institution-focused approach to investing. His career reflects strategic patience, intellectual rigor, and a preference for substance over visibility. While limited public information leaves some questions unanswered, what is confirmed demonstrates a lasting influence on global technology investment.

His story is not one of constant headlines, but of quiet consistency, calculated risk, and structural impact. For those studying modern finance, Thomas Laffont offers an example of leadership built on depth rather than display.

Frequently Asked Questions (FAQs)

Who is Thomas Laffont?

Thomas Laffont is an American investor and co-founder of a global technology-focused investment firm.

What is Thomas Laffont known for?

He is best known for his leadership role in building a major investment platform focused on technology and innovation.

Where did Thomas Laffont study?

He completed his undergraduate education at Yale University.

Is Thomas Laffont active in the media?

No, he maintains a low public profile, with limited personal media appearances.

What industries does Thomas Laffont focus on?

His work centers on technology-driven sectors across public and private markets.

Is Thomas Laffont’s net worth publicly confirmed?

No, exact figures are not publicly verified and should not be assumed.